How to Set Up an HSA

You can open a health savings account at any bank or credit union. Most insurance companies offer HSAs through a specific bank they have partnered with, but these banks often charge high service fees.

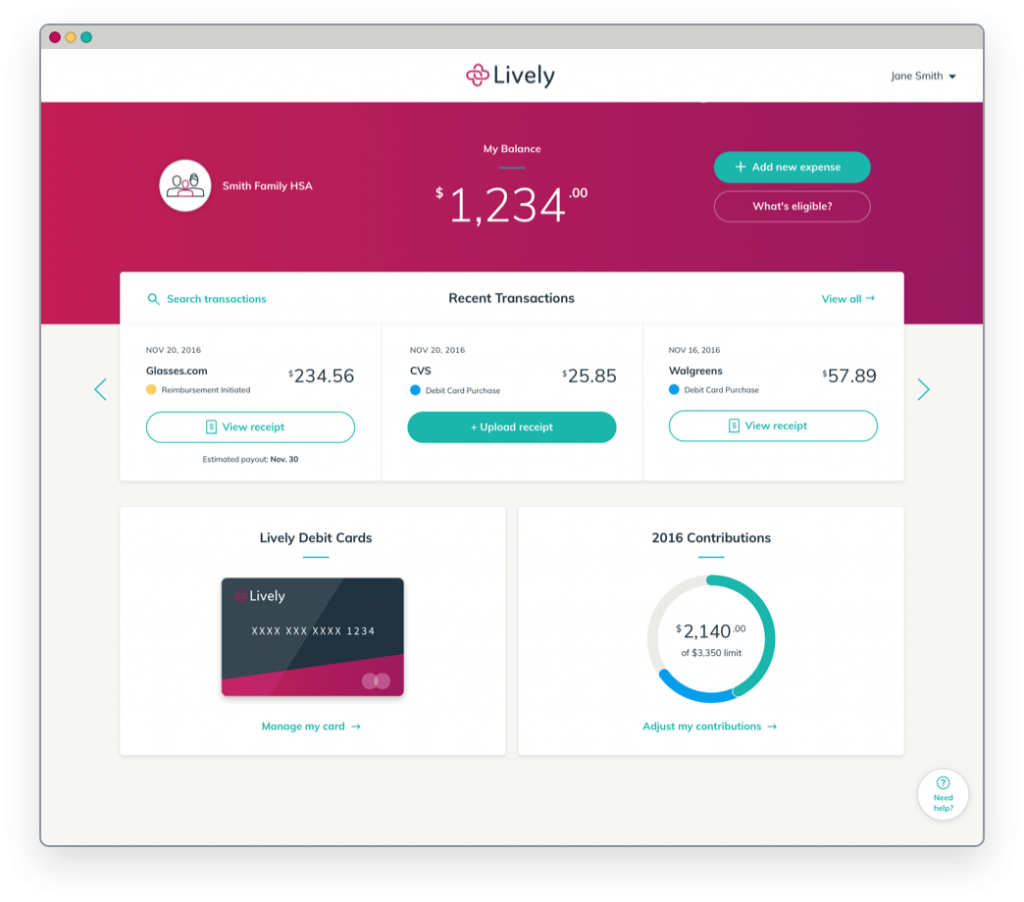

We recommend using Lively because they:

- Offer free HSA Accounts for Individuals

- Provide a free debit card

- 100% online and paperless and only take 5 min to sign up

Lively Health Savings Accounts

Lively HSA Features include:

- FDIC-Insured, Interest Bearing Accounts: We know how important this money is so it’s sitting in an FDIC-insured account that earns interest. The more you save, the more you earn.

- HSA Investments: Invest from day 1 (no minimum required). Lively has partnered with a TD Ameritrade to provide easy online investing with no pre-selected line-up. Stocks, bonds, ETFs, mutual funds are all available. Grow your health savings for the long term for $2.50/month.

After HSA Enrollment

After you enroll in a Health Savings Account, your bank or administrator will send you the same materials you would receive after opening up a checking or savings account. This normally includes:

- An HSA welcome kit that contains all the information about the account and the associated fees

- A debit card, unless requested otherwise on the application

- A sweet online account to manage your HSA account

Ready to shop HSA Plans?

Check out our list of eligible health plans, and then hit get quotes to find the right HSA for you.

Not Sure Which Policy Is Right For You?

Frequently Asked Questions: